How To Calculate Profit Margin & Tips To Improve Profitability

When it comes to maintaining a business and promote its profit, you should take into account many factors. One key to those depends on measuring how your company has performed. There is a reliable indicator of success, which is used by almost every entrepreneur leading business. Using this indicator determined by calculating the profit margin will probably grow your business and step ahead to success.

However, businesses currently have little or no knowledge about Profit margins and the way to calculate them. Knowing the rising demand of looking for information about Profit margins, we have this post today that will show you all things you need to know about the definition of profit margin, calculate profit margin, and tips to improve profitability.

Related posts

- Marketing communications: Definition, Goals, Types, and More

- 15 Best Ecommerce Unique Selling Proposition Examples!

- How To Calculate Variable Cost?

- How To Calculate Conversion Rate of a Website?

What is the profit margin?

Profit margin is one of the most common financial ratios used in corporate finance. It is also said to be the simplest metric suggested to entrepreneurs who need evidence to see how much money or profit their business has been making. Indeed, it is a measuring tool applied for calculating whether your company worked effectively or how you use earnings to pay for outgoing expenses. It means that the profit margin will decide what percentage of revenue your company is keeping.

Using the profit margin, you can find out the profitability of your business during a specific time period. Also, you will have a chance to track your business’s health and, therefore, run many appropriate business decisions in the long term. Moreover, the profit margin will also be a metric given to investors and brings them more information or data to compare with other companies or corporations that have similar revenue.

For those who do not know, a company’s profit is measured at three levels on its income statement:

- Level 1: The most basic one is Gross profit

- Level 2: The one stays between the two levels is Operating profit

- Level 3: The most comprehensive one is Net profit

There has typically been a misunderstanding between Net profit and Profit margin. Entrepreneurs, especially newbies, often get confused when defining them. However, there is still a dissimilarity between profit and profit margin. To be more specific, you need to take away all the costs from earnings to know your profits. Profits will not show the percentage. Instead, it will present the dollar amount that your business owns after costs. All the above levels have equivalent profit margins calculated by dividing the profit figure depending on the revenue and multiplying by 100. The detailed definition and information about these three levels will be presented more in the next part of this article.

Two examples of profit margin

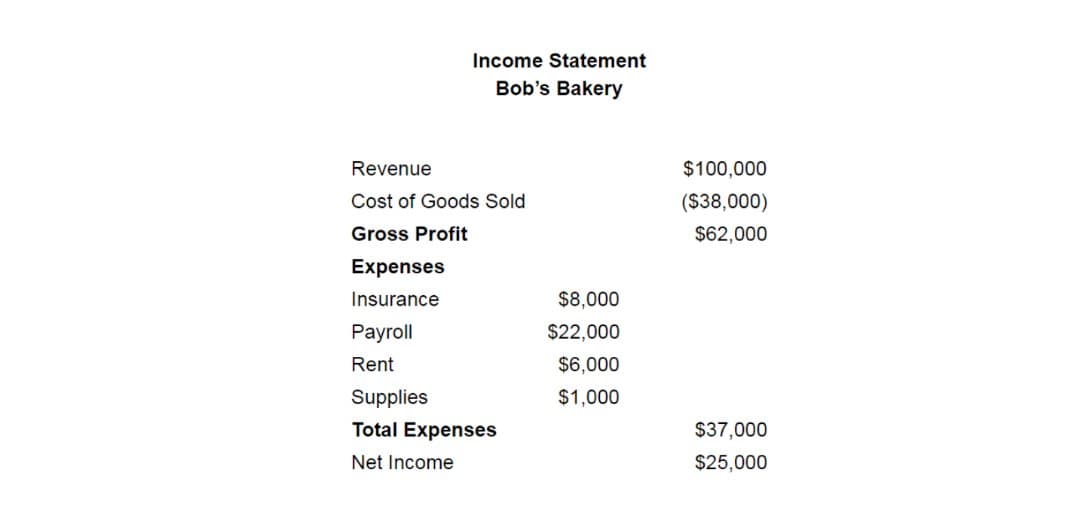

Example 1: Bob’s Bakery

After digging into the profit margin definition, let’s walk through the process and get a complete understanding of how profit margin works. The first instance will go along with the steps, so remember to keep them in mind when discovering how to discover profit margin.

The example is about the brand Bob’s Bakery, which is looking for business capital to expand the business to reach a higher level. During the process of expanding the company, they need to persuade the potential investors that the business is making money for real. Also, they need to claim and determine how well the company is using its incoming money. Now, we will have to use the income statement of the bakery to make clear its profitability.

Step 1: Determine the net income

First, we need to take the total expenses away from the company’s revenue to find net income. As you can see, when the total expenses are $75,000 and the revenue is $100,000, then the net income is $25,000. Remember that the total expenses include the cost of goods sold and operating costs.

Therefore, as you can see: $100,000 Revenue – $75,000 Expenses = $25,000 Net Income

Step 2: Divide the net income by the revenue

Now we have $25,000 net income found in Step 1. Let’s use this number, calculate net income divided by revenue. To help you get it easier to understand, you should divide $25,000 by $100,000 to get 0.25.

Formula: $25,000 Net Income / $100,000 Revenue = 0.25

Step 3: Multiply the result by 100

Finally, to make the ending result a percentage, multiply the 0.25 by 100.

As a result, we have 0.25 X 100 = 25% Profit margin

Accordingly, the profit margin is 25%. It means Bob’s Bakery keeps 25% of their earnings after covering expenses.

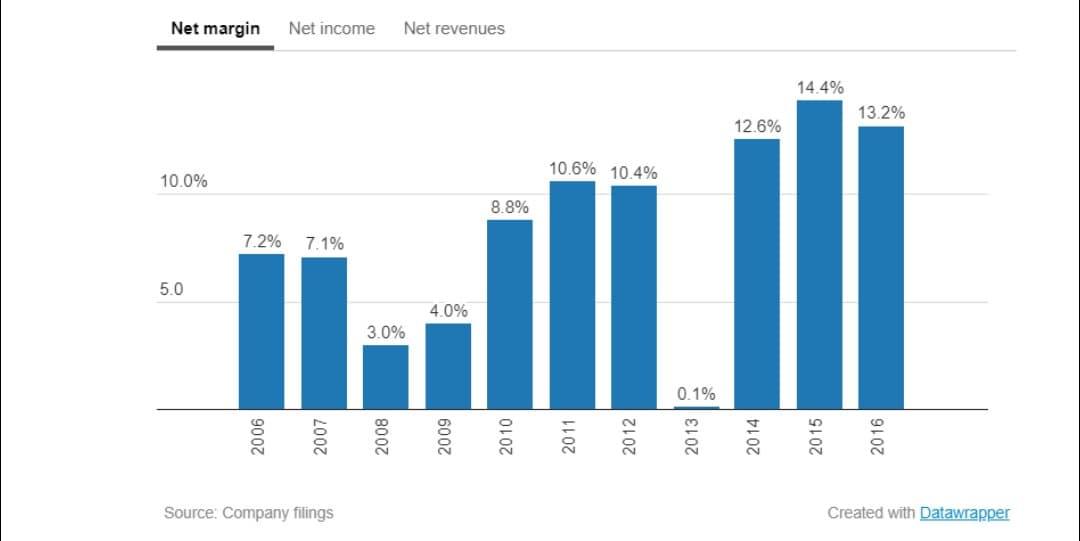

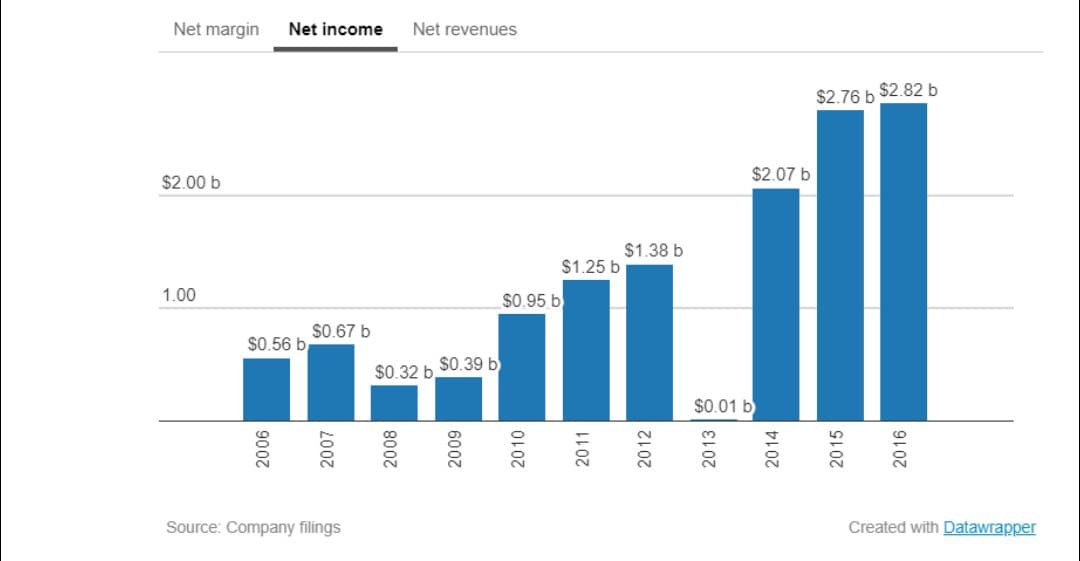

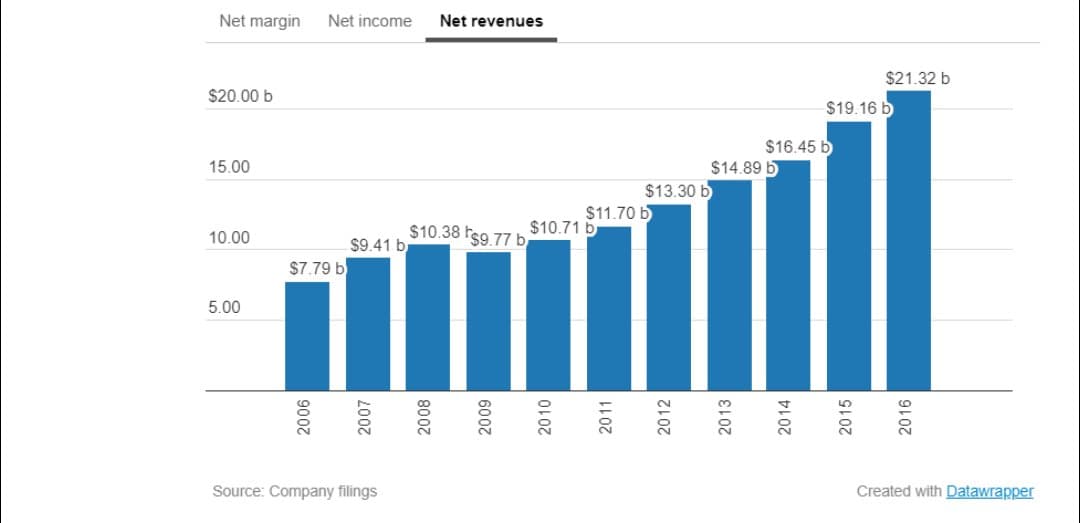

Example 2: Starbucks

Applying the steps above for the second example of SBUX (Starbucks Corp). In the fiscal year, which was ended in October 2016, Starbucks Corporation indicates its revenue reaching the final of $21.32 billion. Gross profit and operating profit at healthy figures were $12.8 billion and $4.17 billion in turn. The net profit of the year is $2.82 billion.

Therefore, we can use the formula mentioned earlier to calculate the profit margins for Starbucks:

Step 1: Identify gross profit margin

Gross profit margin = ($12.8 billion ÷ $21.32 billion) x 100 = 60.07%

Step 2: Use the same formula to determine operating profit margin

Operating profit margin = ($4.17 billion ÷ $21.32 billion) x 100 = 19.57%

Step 3: Find the net profit margin

Net profit margin = ($2.82 billion ÷ $21.32 billion) x 100 = 13.22%

The example of Starbucks does clarify the key importance of owning strong gross profit margins and operating profit margins. It is because if you have these levels staying at a low number, the weakness will demonstrate that money is being lost on basic operations, and there will be little revenue for other expenses. As you can see, when Starbucks has such healthy gross and operating profit margins as the example showing above, the corporation can remain decent profits and still meet all of its financial obligations at the same time.

How to calculate profit margin?

As we mentioned earlier, there are three levels to look at profit margins, which are Operating profit margin, Net profit margin, and Gross profit margin. Each type of margins has its profitability. Despite having some similarities and making users confused when defining, the following three levels are different.

Gross Profit Margin

The first level, which is also the simplest profitability metric called Gross profit margin. According to it, profit is all income that remains after we account for the cost of goods sold. This cost of goods sold is also known as COGS. The reason why we define gross profit margin the simplest one is because COGS includes only the expenses which are directly connected with the production or manufacture of products for sale. It also includes raw materials and salaries for labor, which are all required to produce or assemble goods. However, some of which are expelled from this figure are expenses for debt, taxes, operating costs, or overhead costs. Also, among other things, it will not include one-time expenditures such as equipment purchases. Therefore, you cannot use gross profit margin to measure your business’s overall profitability but look at other levels, which might be the net profit margin.

Additionally, the gross profit margin makes a comparison between gross profit and total revenue. By reviewing this comparison, we can see the percentage of each revenue dollar reflected. This percentage is maintained as a profit after paying for the cost of producing. The plus point of gross profit margin is that you will have a chance to know the most profitable products and which ones will bring you the least profit. It is because gross profit margins are used to track the profitability of a single product or service. Therefore, it allows you to see the amount of revenue from each item that you are keeping.

Operating Profit Margin

The second one is called Operating profit margin, which is said to be just a slightly more complicated metric. Similar to the gross profit margin, operating profit one also considers and includes all overhead, operating, administrative, and sales expenses. In general, these are all necessary to manage and develop the business on a day-by-day basis. It also includes the amortization and depreciation of assets, although it will not provide you with debts, taxes, and other non-operational expenses. The operating profit margin is called the mid-level profitability margin, which will divide operating profit by revenue. In this way, it will present the percentage of each dollar left after paying for all expenses, which are essential for keeping the business running well.

Net Profit Margin

As we mentioned above, we cannot use gross profit margin to measure your business’s overall profitability but look at other levels, which might be the Net profit margin. It will help you better understand the company’s whole possibility of making money or profit from income. On the other hand, the net profit margin will make a comparison between the total earnings and expenses. Net profit margin is what people will mention while determining the profitability of a company. That’s why users tend to get misunderstanding while searching about net profit margin and profit margin.

It is the more complex level and also the infamous bottom line. By finding the net income, you will have the opportunity to know the total amount of revenue that remains after when all expenses and additional costs are accounted for. In terms of what it includes, they are COGS and operating expenses which are referenced in the previous part. Also, it includes payments on debts, taxes, one-time expenses or payments, and any income from investments or secondary operations.

How to make a higher profit margin?

Before getting to know how to improve profit margin, it is better to understand what standard margins mean. There will be surely some differences between two or more companies. Being a small business owner, you must have known these things already. What’s more, it will be so difficult for small businesses to know its average profit margin.

There are a lot of different factors deciding what the average net profit margin will be. Those factors that you should take into account include the type of business you manage, the number of staff members you employ, and where your business locates. In addition to this list, operating systems, use of business assets, and inventory management also have an impact on profit margin.

Remember that each company has its own average profit margin so you will not be able to make any comparisons between your profit margin and other businesses that are operating in other industries. The list below will show you the average profit margins of some common industries in the market nowadays:

- Retail clothing: 7% to 12%

- Telecommunications: 10% to 15%

- Equipment manufacturing: 6% to 10%

- Electronics stores: 5% to 8%

Though you cannot compare your profit margin to others from different industries, you are capable of comparing yourself to small businesses in the same industry (of course, not every business). It is because most developing businesses have less than $2 million in sales every year and have the number of employees of fewer than 20 people.

Improving profit margin is the target of many businesses currently. In order to reach that goal, you need to make some adjustments. There are two key tips you should consider: lowering costs and increasing sales to enhance profit margin.

Lowering your costs:

- Getting rid of offerings that do not sell: They are items or products taking up space and will not convert into dollars

- Changing vendors: You are suggested to make more research and shop around to find among multiple different vendors to reach a better deal

- Reducing waste: Remember not to buy unnecessary items and reduce business expenses. In order to do that, let’s look for different solutions to these processes. For example, you can create a paperless office

Raising your sales:

- Discounting old inventory: It means you you should offer items for sales with lower price and get rid of old inventory

- Increasing your prices: In case you have used one pricing strategy from the first day, it is high time you increase your prices in order to match your experience

- Improving customer retention: Due to the fact that procurement is quite expensive, you are highly recommended to interconnect with social media and apply cross-selling strategies for retaining current customers

Further readings

Conclusion

As you can see, profit margin also known as profitability metrics take an important play in helping us see how well our business decisions work. It is essential for business owners to get to know better about the weakness and strength in the operational model as well as enable year-to-year performance comparison. Not only is it helpful for entrepreneurs, but the profit margin also brings investors implications for its long-run development and investment possibility. Moreover, the profit margin is for both managers and investors to discover the development of the company while generating profits and how they recover from the competition. It means people can use it to compare the profit margins over various periods and over many other competitors in similar industries.

We hope this article has provided you a better understanding of profit margins and how important they are to business owners and investors. If you are considering upgrading your business, let’s use this business metric to calculate your company’s progress and health.

New Posts