How to Do Market Research for a Startup?

Consumers today have a lot of control over how they decide to buy a product. They will research your product or service and make buying decisions on their own. On top of that, rather than talking to your sales rep, they are more likely to ask for referrals from their friends or read online reviews.

With this knowledge in mind, have you adapted your marketing plan to complement the way consumers look for information, browse products and make purchases today? To do so, you need to have a deep understanding of who your customers are, what your particular market is, and what influences the purchasing choices and actions of your target audience. If you’re new to market research, this guide will provide you with a blueprint to conduct a comprehensive study of your market, target audience, competition, and more. Let’s jump right into the details!

What is market research?

Market research is a method of collecting information about customers, target markets of a business to assess how feasible and profitable your product or service can be once it’s introduced.

Why should you do market research?

Market research helps you find out about who your ideal customer is and where they are. When our world (both digital and analog) is becoming louder and constantly demanding our attention, this proves to be valuable for business decision making. By knowing the concerns of your customer, the pain points, and the solutions they seek, you can build your product or service to cater to your customers’ needs effectively. The market research also offers insight into a wide range of things that affect the bottom line, such as:

- Where your target audience and existing customers are looking for information about the product or service they’re about to buy.

- Which of your competitors can offer what your target audience is looking for?

- Who is making up your competition and how they can challenge your business?

- What is the deciding factor that your customers use to make their buying decision?

When you begin honing in your market research, you’re likely to learn about primary and secondary market research. The best way to think about primary and secondary research is to look at umbrellas under market research: one is a primary market research and the other is secondary market research.

Below these two umbrellas are a variety of different forms of market analysis, which I will address below. Identifying which of the two umbrellas your market research falls under is not inherently important, although some marketers tend to make it clear about the distinction. So, if you meet a marketer who wants to describe the forms of market research as primary or secondary—or if you are one of them—look let’s at the meanings for the next two groups. Then, in the following segment, we will look at the various forms of market research.

Primary vs. Secondary Market Research

There are two key types of market research that your company can perform to gain actionable information about your product offerings, including primary and secondary research.

Primary Market Research

Primary research is the discovery of first-hand knowledge about your industry and consumers in your market. It’s useful when segmenting the market and setting up people for your consumers. Primary market research appears to fall into one of two groups: exploratory and specific research.

Exploratory Primary Research

This type of primary market research is less concerned with observable consumer dynamics and more about future concerns that would be worth tackling as a team. It typically takes place as the first step—before any concrete study has been carried out—and can include open-ended interviews or surveys with a limited number of people.

Specific Primary Research

Specific primary market research then often follows exploratory research and is used to dive deeper into problems or opportunities that a business has already identified as important to solve. In specific research, a company may take a smaller or more precise segment of its audience and ask questions aimed at solving a potential problem.

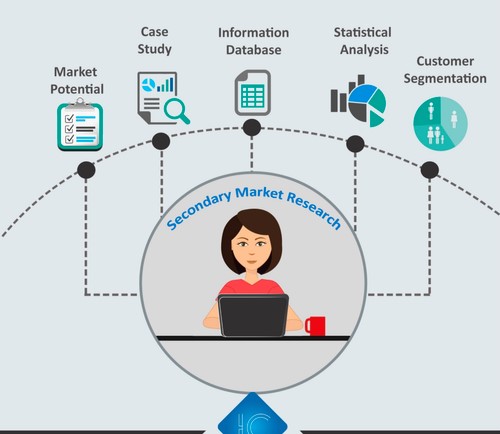

Secondary Market Research

Secondary research is all the information and public records (e.g. market statistics, trend reports, industry content, and sales data you already have owned )that you can use to draw conclusions from. Secondary research is especially useful for the study of your competition. Your secondary market analysis would fall into these categories:

Public Sources

Public sources are the most accessible source of material for secondary market research. They’re also free to find and study. According to Entrepreneur, government statistics are one of the most popular forms of public sources. Two examples of public market data in the US are The Census Bureau and the Bureau of Labor & Statistics, which provide valuable information on the condition of different industries around the country.

Commercial Sources

Commercial sources also come in the form of market studies, consisting of business insights gathered by research firms such as Pew, Gartner, and Forrester. Since this information is so versatile and portable, it normally costs money to download and get it.

Internal Sources

Internal is the industry data that your company already has! They should receive more intention for market research than they usually do. Why is it so? Average sales income, consumer retention rates, and other historical data about your existing customers will all help you draw conclusions on what your customers might want right now. Now that we’ve discussed these overarching categories of market research, let’s look at the different forms of market research that you can choose to do.

Types of Market Research

Interviews

Interviews are face-to-face conversations (in-person and virtual) where you can maintain a natural flow of interaction and watch the body language of your interviewee while you’re at it.

Focus Groups

Focus groups are groups of carefully chosen people who will test your product, watch a demo, provide input, and/or answer specific questions.

Product/Service Use Research

Usage research on a product or service provides insight into how and why the audience uses your product or service and the unique features of that product or service. This form of market research often gives you an idea of how your product or service is used by your target audience.

Observation-Based Research

Observation-based research is watching how your target audience uses your product or service, then finding out what works well UX-wise, what obstacles they encounter, and which parts of the product might need improving.

Customer Persona Research

Customer persona research gives you a realistic look at who your target audience is, what their problems are, why they want your product or service, what your company and brand needs, and more.

Market Segmentation Research

Market segmentation research helps you to categorize your target audience into different categories (or segments) based on unique and distinguishing characteristics—so you can find successful ways to address their needs, consider their pain points and preferences, learn about their priorities, and more.

Pricing Research

Pricing research provides you with an idea of what similar goods or services are selling on your market, what your target audience is willing to pay, and what a profitable price it is for you to sell your product or service. All this knowledge will help you determine your pricing plan.

Competitive Analysis

Competitive analysis is useful because they provide you with a thorough understanding of competition in your business and your industry. You will hear about what’s going well in your market, what your target customers are already buying in terms of products like yours, which of your competitors you should keep up with, and how you can clearly differentiate yourself from the competition.

Customer Satisfaction and Loyalty Research

Customer satisfaction and loyalty research will give you a peek at how you can get existing customers to buy more and what motivates them to do so (loyalty programs, rewards, remarkable customer service, etc). This research will help you find out the most effective ways to maximize your customer lifetime value.

Brand Awareness Research

Brand awareness research shows you how your target audience recognizes your brand. It gives you insights into what comes to your target customers’ minds when they think about your business, which will allow you to maintain or improve your brand image.

Campaign Research

Campaign analysis includes looking at your previous campaigns and assessing their success with your target audience. It needs experimentation, and then a deep dive into what has resonated with your audience, so that you can hold those elements in mind for your future campaign. Now that you know about the definitions and types of market research, let’s look at how you can carry out your market research.

Here’s how to do market research step-by-step.

5 Steps to Do Market Research for a Startup

Step 1. Define your buyer persona.

Before you discover how customers in your industry make their purchase decisions, you must first find out who they are. This is where building your customer persona comes in handy. Customer personas are fictitious, simplified depictions of your ideal customer.

It enables you to visualize your audience and come up with how you can sell to them. Some of the main characteristics that you should include in your customer persona are:

- Age

- Gender

- Location

- Job title(s)

- Job titles

- Family size

- Income

- Major challenges

The idea is to use this customer persona as a guideline about how you can effectively market your brand to your target audience. In case your business may have more than one customer persona, this is all fine, but you will need to think about each persona as different when you’re planning your content and marketing campaigns for each of them.

Step 2. Identify a persona group to engage.

After you have defined your customer persona, you should know who your ideal customer is. Now you use that knowledge to help you identify a demographic with whom you will do your market research—this should be a representative sample of your potential customers so that you can better understand their real attributes, problems, and purchasing preferences.

The demographic you’re about to explore should also be made up of people who have recently made a purchase or have deliberately chosen not to make one. Here are some more guidance and tips to help you bring in the right research participants.

How to Identify the Right People to Recruit for Market Research

When deciding who to bring into your market research, start with people that have characteristics that are similar to your customer persona. You can also aim for 10 participants per customer persona.

- Gather a mix of participants. You’d want to choose customers who have bought your product, bought a competitor’s product, and chosen not to buy anything at all. Although your customers would be the easiest to identify, sourcing information from non-customers (yet!) will help you build a balanced view of your business. Here is some more information about how to choose this combination of participants:

- Gather a list of customers who made a recent purchase. This is typically the easiest group of buyers to recruit. If you are using a CRM system, you can run a transaction report that has been closed for the past six months and filter it to get the characteristics you are searching for. Otherwise, you should work with your sales staff to get a list of the suitable accounts.

- Gather a list of customers who have not made a purchase. You should get a combination of customers who either bought from a competitor of yours or haven’t made a purchase. Again, you can extract this list from your CRM or whatever system your sales team uses to track offers.

- Recruit social media participants. Try to reach out to the people who follow you on social media, but have not bought from you. There is a possibility that some of them would be able to speak to you and tell you why they haven’t purchased your product.

- Leverage a network of your own. Get the word out to your friends, former colleagues, and LinkedIn connections that you’re undertaking a report. Even if the direct connections don’t count, some of them are likely to have a coworker, friend, or family member.

One thing to consider is you should provide an incentive. Time is precious for everybody, so you’ll need to think about how you’re going to inspire others to spend 30-45 minutes on you and your studies. Are you on a small budget? You can reward participants for free by providing them with exclusive access to content, but it’ll be better to prepare a small but meaningful gift.

Step 3. Prepare research questions for your market research participants.

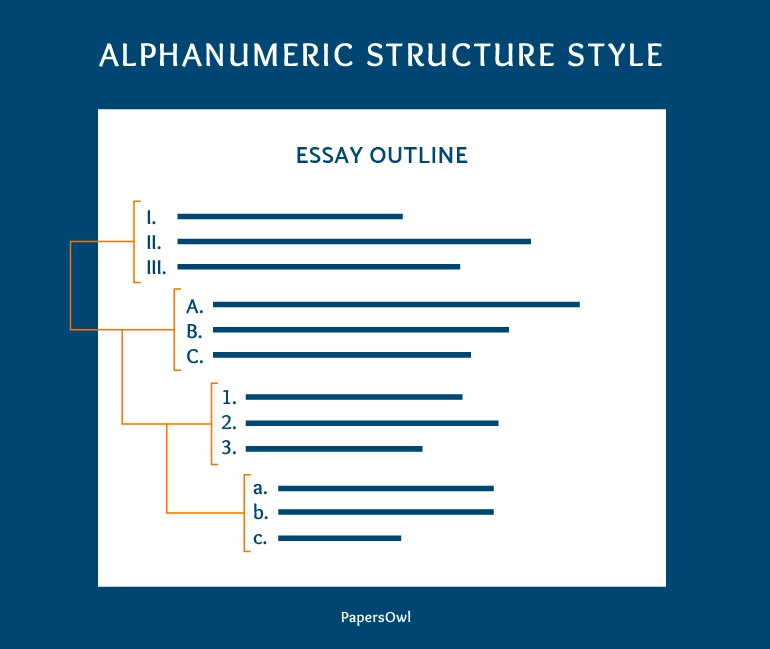

The best way to make sure that you get the most out of your interviews is preparation. You should always develop a conversation guide—whether for a focus group, an online survey, or a phone interview—to ensure you will cover all the top-of-the-mind issues and use your time wisely. One thing to keep in mind is that this is not supposed to be a script. Discussions should be normal and conversational. Your discussion guideline should be in an outline format, with time allocations and open-ended questions for each segment.

Open-ended questions are a cardinal rule for market research. You shouldn’t “lead the witness” by asking yes and no questions, because that leaves you at risk of unintentionally swaying their thoughts by inflicting your own theory. Asking open-ended questions also helps you escape one-word responses (which are not really helpful to you).

Example Outline of a 30-Minute Survey

Here is a general outline for a 30-minute survey that you can do with a B2B buyer. You may use these as points for an in-person interview or as questions asked in a digital form with your target customers.

Background Information (5 Minutes)

Ask the buyer to send you some background details (the first product they bought from your company, how long they’ve been using the service, and so on). Note, you’re trying to get to know your customers in very unique ways. You may be able to grab basic details such as age, place, and job title from your contact list, but there are some personal and professional obstacles that you can still only discover by asking. Here are some other main context questions for your target audience:

Now, let them know the particular transaction or connection they have made with the business that has led you to include them in your research. The next three phases of the customer journey will focus on the purchase.

Awareness (5 Minutes)

Here, you want to understand how they first discovered that they had an issue that needed to be solved without getting to know whether or not they already knew about your brand.

- Think back to when you first knew that you wanted [name of product/service category, but not of your own]. What challenges did you face at the time?

- How did you know that you could be helped by anything in this category?

- How familiar were you with the various options on the market?

- etc.

Consideration (10 Minutes)

Now you want to be very specific about how and where the buyer has looked for possible solutions.

- What did you do to find possible solutions?

- How helpful was this source of information?

- Where were you going to find more information?

If they’re not coming up naturally, bring up search engines, websites visited, people consulted, and so on with some of the following questions:

- How did you find the source?

- How did you use the vendor’s websites?

- What particular words did you look for on Google?

- How beneficial was that? How could it have been better?

- Who got the most (and least) valuable information? What did it look like?

- Tell me about your interactions with each vendor’s salespeople.

Decision (10 Minutes)

- Which of the sources you mentioned above has been the most important in guiding your decision?

- What, if any, factors did you use to compare the alternatives?

- What vendors have made it to the shortlist, and what were the pros/cons of each?

- Who else has been interested in the final decision? What was the role of each of these people?

- What factors ultimately affected the final buying decision?

Closing

Here, you want to sum up and understand what would have been better for the buyer. Tell them what their ideal purchase method will look like. How will it be different from what they’ve experienced?

Make time for more questions from the customer, and don’t forget to thank them for their time and confirm their address to give a thank you note or reward.

Step 4. List your primary competitors.

List your primary competitors—bear in mind that listing the competition is not always as easy as Company X versus Company Y. Often, a division of a company may compete with your main product or service, even though that company’s brand might make more effort in another region.

Apple is popular for its computers and mobile devices, for example, but Apple Music competes with Spotify through its music streaming service. From a content point of view, you can compete with a blog, YouTube channel, or similar publication for inbound website visitors—even if their product or service doesn’t overlap with yours at all. A toothpaste company could compete with magazines like Health.com or Prevention on some of the health and hygiene-related blog topics even though the magazines don’t actually sell oral care items.

Identifying Industry Competitors

To identify competition whose products or services compete with yours, decide which industry or industries you are studying. Start high-level, using words such as education, construction, media & entertainment, healthcare, food services, financial services, retail, telecommunications, and agriculture. The list goes on, so find the name of the sector in which you associate and use it to draw up a list of companies that are also part of this industry. You may create a list of the following ways:

- Download a business report: Sources such as Forrester and Gartner give both free and up-to-date market reports each year to the leading suppliers in various sectors. For instance, on Forrester’s website, you can choose “Latest Research” from the navigation bar and browse Forrester’s latest rankings using a variety of criteria to narrow your search. These reports are good assets that can be saved on your computer.

- Search using social media: whether you believe it or not, social networks make perfect company directories if you use the search bar correctly. For instance, on LinkedIn, select the search bar and enter the name of the industry you’re pursuing. Then, under “More,” select “Companies” to narrow down your results to companies that have this or a related industry word on their LinkedIn profile.

Identifying Content Competitors

Search engines are the best tool you can use for secondary market analysis. To find the online publications that you compete with, take the overall industry term that you listed in the section above and come up with a handful of more relevant industry terms that your business associates with. A catering business, for instance, may generally be a “food service” company, but it also considers itself a vendor in “cake catering,” “event catering,” “baked goods,” and more.

Once you have this list, do the following:

Google it: Don’t underestimate the importance of seeing which websites come up when you check Google for the words of the industry that your company defines. You could find a mixture of product creators, blogs, magazines, and more.

Compare your search results with your buyer persona: remember the buyer persona you created earlier in this article at the primary research level? Use it to analyze how likely a publication you’ve found through Google could compete for traffic with you. If the content that the website publishes appears to be what your buyer persona needs to see, it is a possible competitor and should be added to the list of competitors.

After a series of related Google searches for the words of the sector that you associate with, check for repetition in the domains of the website that have come up. Examine the first two or three pages of results for each search you’ve made. These websites are clearly valued for the content they produce in your industry and should be closely watched as you build your own library of videos, papers, web pages, and blog posts.

Step 5. Summarize your findings.

Feeling exhausted by the notes that you took from this article already? I’d recommend that you search for common themes that will help you tell a story and create a list of actions. To make the process simpler, consider using your favorite presentation program to make a report, as it will make it easy to add quotes, graphs, or call clips. Feel free to add your own flair, but the following description should enable you to make a concise summary:

- Background: Your ambitions and why you did this research.

- Participants: who you were referring to. The table works well so that you can break down the categories by individual and customer/prospect.

- Executive Summary: What were the most fascinating things you’ve learned? What are you going to do about it?

- Awareness: identify the common causes that lead someone to take part in an assessment.

- Consideration: Include the key trends you have uncovered, as well as the detailed sources used by consumers to test them.

- Decision: convey a picture of how a decision is actually made by having individuals at the center of control and any product features or details that can make or break a contract.

- Action Plan: Your research has undoubtedly revealed actions that you can take to bring your brand in front of your customers sooner and/or more efficiently. Provide your list of priorities, the timetable, and the effect that it will have on your company.

Final words

That was a long article indeed! If you have read up to this point, I’m sure that you have just acquired a great amount of knowledge to level up your next market research. Please feel free to leave comments below for a further discussion on this topic.

New Posts