Wells Fargo Merchant Services Review - What Users Should Know?

Wells Fargo is well known as the mega-bank brings consumers and business services to nearly 70 million users around the United States.

However, one service especially for sellers is hardly known, which is Wells Fargo Merchant Services. Having many merchant services divisions, Wells Fargo also has a credit card processing service.

In this post, we will give you everything you need to know about this service, which includes the highlighted features and the pros and cons of using Wells Fargo Merchant Services.

Let’s dive in!

What is Wells Fargo Merchant Services?

Before digging into what Wells Fargo Merchant Service brings about, let’s look at what it is first!

Wells Fargo is known as one of the biggest and oldest banks in the United State. Wells Fargo Merchant Services (WFMS) is a service supported by Wells Fargo which is for merchants and eCommerce purposes. It is normal for a merchant to create an account with his or her bank in an attempt to fulfill the business tasks. But isn’t it really a good idea?

Wells Fargo Merchant Service is not a main division of Wells Fargo, and the company offers it as an afterthought only. They put little or no motivation to display competitive terms or prices. Moreover, when using this company’s merchant service, you need to be ready to solve the problems on your own since customer service is almost universally below-par. Moreover, the company will not improve its speed on depositing as it promises. Therefore, it is highly recommended that merchants should approach more competing merchant services providers instead.

When dating back to 2016, Wells Fargo got a $190 million settlement with the Consumer Financial Protection Bureau (CFPB). The company declared that the staff had set up more than two million unauthorized accounts in a systematic way in an attempt to get their sales target. Unluckily, there have been many violations after that which charged Wells Fargo. Noticeably, the insurance sales practices are improper, and the selling of residential mortgages contains wrong information.

Though you just can find the fraud of Wells Fargo via the consumer division of the company, the opening of bogus accounts seems to impact small businesses. According to some research and reviews of consumers, nearly 10,000 small business accounts have been identified as being created while the consumers have no ideas about it. In this way, merchant accounts can also be affected.

One more problem related to Merchant Services of Wells Fargo is its failure to disclose the promised information. In 2017, there was a class action filed by many merchants. They said that Wells Fargo Merchant Service engaged in deceptive sales practices by not revealing the three-year term agreement, early termination fees, and other monthly fees.

What’s more, being a huge company in the world, Wells Fargo is not a direct processor and it has to use Fiserv as a back-end processor. If you have used or reviewed the company before, you must have found that this relationship appears with all payment processors that offer Clover products. Therefore, merchants have to deal with both Wells Fargo and Fiserv, which is pretty risky with many issues affecting Fiserv merchants.

However, Wells Fargo Merchant Service has got rid of the three-year contract term and early termination fee for merchants on standard pricing. Moreover, the company is also changing its plans and practices. Being a reliable and large bank, Wells Fargo is still trusted and used by many business owners while having business banking needs. Although Wells Fargo Merchant Service has the products and features underwhelming as well as bad customer service, it does not mean you should not try it out.

If you are going to use it, read the following review carefully and get your best decision of whether to move on or not.

What does Wells Fargo Merchant Services offer you?

As we have mentioned, Wells Fargo Merchant Services will allow you to have your credit card and debit card transactions accepted from all of the major credit card issuers in your store, online, and on mobile devices.

However, Wells Fargo credit card processing means First Data credit card processing through Wells Fargo Merchant Services because all the process is made via First Data. Besides the general account and connection to First Data credit card, what else this service brings to your business?

-

Processing via mobile: Whatever phone you are using, you can also accept and process mobile payments with the app your phone offers like Apple Pay, Android Pay, and more.

-

Terminal sales or leases: When using Wells Fargo Merchant Services, you are an account holder that can buy terminals for your business. To rent your terminal, simply start a lease with First Data Global Leasing.

-

Payment gateway: You can indirectly support your eCommerce presence with the help of a Wells Fargo Merchant Services account. To accept payments online, you can use a payment gateway through First Data’s Payeezy Gateway.

-

POS: In terms of point of sale, Wells Fargo Merchant Services also brings you a chance to work with First Data’s Clover Station and other Clover products.

-

Data encryption: You can protect your customer’s card data with encryption technology from the Wells Fargo Merchant Services “TransArmor solution”.

-

EMV support: You can accept cards with the EMV chip when using Wells Fargo Merchant Services.

Wells Fargo Merchant Services review

Fees & Rates

Wells Fargo Merchant Services used to reveal information related to its pricing on its website. However, it does not disclose its prices anymore. Instead, WFMS is providing a flat-rate pricing plan for business processing, which costs no more than $100,000 a year.

The pricing plan of Wells Fargo is very simple which includes two available rates:

- 2.6% + $0.15 per transaction for card-present payments

- 3.4% + $0.15 per transaction for card-not-present payments

Being a big competitor of Square, Wells Fargo Merchant Service also includes month-to-month billing and users do not need to sign any long-term contracts or pay an early termination fee for closing their accounts.

What the company fees cost your business will depend on various factors. They may include:

- Business type you are managing

- The processing volume of your business

- The processing method, in-person one, online, or by phone method

- The card type your customers are using

- The setting up method of your merchant account

When it comes to additional fees, Wells Fargo credit card processing takes you a lot:

- $9.95 monthly account fee which is used for only in-person payments

- $24.95 monthly account fee for online payments

- $5.00 per location per month Non-Wells Fargo Deposit Account Fee

- $25.00 chargeback fee per occurrence

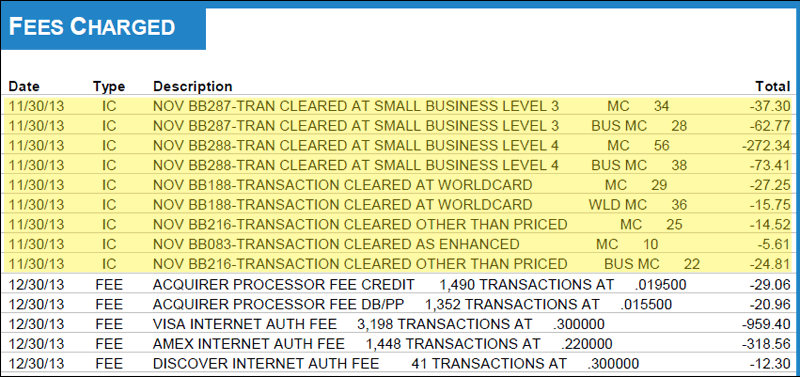

Only when you call directly the Wells Fargo Merchant Services phone number to ask for a quote will you know exactly what you have to spend. However, here’s a general idea of what might show up on your statement:

-

Discount rate: The rate here is similar to the service charges. It is the percentage the company gets from a transaction and it is the cost of authorizing, processing, and settling a transaction.

-

Transaction fees: When making a transaction, Wells Fargo Merchant Services will charge you a fixed-rate fee for each. The fee depends on the credit card issuer of the given transaction as well as your account so it is hard to know exactly what these rates will be.

-

Interchange charges: When using Wells Fargo Merchant Services, you will have to spend an amount on the interchange fee. Again, the exact amount you have to pay will be based on the card issuer. The interchange fee of Wells Fargo compensates the card issuers for advancing the payment to the merchant until the cardholder is settled.

-

Cancellation fee: Different from others, the cancellation fee is the one that you can know clearly. When you decide to cancel your Wells Fargo Merchant Services account, you will surely have to pay $500 for this service. This fee is only applied to those merchants who are processing less than $1 million per year in transactions. If you don’t, it will take you both the $500 early termination fee and liquidated damages. Unluckily, this fee is six times the highest amount of revenue in any single calendar month during the initial term or any renewal term.

Features & Service

As the platform claims, the Wells Fargo Merchant Service is suitable for small businesses and then merchant services. When it comes to the bank’s main website, the one for merchant services is difficult to navigate and missing importing data. What’s more, there are no clear descriptions of products and services. The website is also riddled with asterisks and footnotes, which makes it challenging to look at.

In fact, Wells Fargo Merchant Service is not the platform that owns a bunch of value-added features. Instead, it only offers some basics as we are about to list right now:

Merchant account

In terms of merchant accounts, Wells Fargo Merchant Service makes use of Fiserv to serve as a back-end professor. You may find that this agreement will not affect you in a direct way. However, if you are about to get a hold of a transaction or an account freeze or termination, this agreement will slow things down.

Mobile payments processing

There is a variety of mobile card readers that Wells Fargo Merchant Service provides, which includes Apple Pay, Google Pay, Samsung Pay, FitBit Pay, and Garmin Pay. They are all mobile payment methods that are based on NFC.

Wells Fargo Merchant Service also offers the EMV app to use the Wells Fargo Mobile Merchant for free. Being available for both iOS and Android phones, the EMV app makes use of the EMV-compliant Clover Go card reader. On the other hand, the company does not bring about any more information about this on its main website.

Terminal sales, rentals, and leases

If you are caring about the standard countertop terminals that support EMV and payment methods based on NFC, don’t worry since Wells Fargo Merchant Service provides its users with many of them. You can freely choose to buy the hardware outright, spend money on renting it for an indefinite period, or sign up for just a three or four-year lease. Among those solutions, leases are handled via a partnership with First Data Global Leasing. Terminal leases are rather expensive and not a good idea in the long-term. Therefore, you are highly recommended to purchase your equipment outright.

Point of sale systems (POS)

Wells Fargo Merchant Service is a type of Fiserv reseller so you will receive a variety of Clover products, which include the Clover Station and Clover Station Pro. Though the actual cost is not revealed, you can surely get a cheaper deal when approaching the recommended Clover resellers. However, remember not to switch processors or your Clover Point Of Sale system will turn into a much expensive paperweight. It is because Clover products cannot be programmed again to work outside the Fiserv processing network.

Payment gateway and virtual terminal

When coming to Wells Fargo Merchant Service, you will be provided with four options of payment gateways thanks to the fact that WFMS supports eCommerce by providing integration. They are all well-known gateways, including Authorize.Net, Fiserv’s Payeezy gateway, the PayPal PayFlow gateway, and the company’s proprietary Wells Fargo Payment Gateway. Because these gateways help your online stores connect directly with Wells Fargo Merchant Services, you can receive support from them in terms of recurring payments, online account management and reporting, and QuickBooks integration.

Online account signup and management

To apply and get an agreement for a Wells Fargo Merchant account in a quicker way than usual, as a small business owner, you can sign up online.

To use this service, you need to fulfill the following conditions:

- You are using a Wells Fargo Business Checking Account

- You process less than $500,000 in annual sales

- One owner of your business must be a US citizen

So what if you have already processed over $500,000 per year? You must want to call Wells Fargo Merchant Service to get a customized pricing quote, right? Only when you are approved will the company provide you with online access to your account and processing statements per month. To provide it, the company makes use of a third-party service, which is Business Track.

Processing lasting one to three days

Most of the other popular merchant account offer deposits within 24 to 48 hours. However, it is surprising that your funds will be deposited in one to three business days when you planned to deposit your funds into a Wells Fargo account and opened that account very recently.

As you can see, Wells Fargo Merchant Service offers many features that help you fulfill basic problems like accepting online or in-person payments. But when it comes to some more difficult tasks, Wells Fargo Merchant Service turns into not workable since it has many drawbacks related to flexibility. The only way to get access to the lowest rates possible is by sticking with the card terminals and gateways that WFMS offers.

Contract length & Termination fee

For those who don’t know, there was a three-year agreement on which Wells Fargo Merchant Services has followed the industry standard of signing new merchants. This agreement did include an early termination fee. You can ask those who are still with Wells Fargo Merchant Service; they surely have a contract with these terms. Nonetheless, recently, the platform has just changed its terms and conditions.

To be more specific, Wells Fargo Merchant Service does not ask for a three-year contract for an early termination fee anymore. In case you are a seller who signed up with the standard pricing model (also known as the flat rate one), you will not be charged any fee for leaving and canceling the service at any time with written notice.

However, when it comes to a custom pricing model as well as Business-to-business merchants, a three-year contract is still required by the merchant platform. In this case, sellers who have to sign up for this contract will only be charged an early termination fee. Conditions for that are you need to process more than $1 million every year and cancel the agreement in the first three years. When calculating them all, the early termination fee can take nearly $500 for each merchant.

Besides, there is also a different Terms of Service document for its Wells Fargo Mobile Merchant EMV application. As long as you submit the written notice of your cancellation 1 month in advance, you can freely leave this service at any time you want.

Moreover, Wells Fargo Merchant Service also provides merchants with credit card terminals and other hardware. As you know, it is free for you to buy this equipment outright or perhaps rent it if you do not the correct time to take it back. But Wells Fargo Merchant Service still advertises 36-month and 48-month leases.

To be honest, you surely should not accept leasing equipment under any conditions. It is because leases can be challenging and even impossible to get out of. More importantly, you will need to pay more than expected since the price of leasing equipment more than three or four years and leads to the fact that you are wasting many times the actual value of the hardware.

Remember that purchasing your equipment outright or renting is just suitable when you need it within 3 months. So, don’t quickly spend money on any costly lease deal.

Customer service

Customer support has never been a plus point of Wells Fargo Merchant Services. The quality of it is always questioned and needs improvement in the long-term. Customers often complain that the Live chat service of Wells Fargo cannot answer any questions or help solve any troubles related to merchant services. What’s more, Wells Fargo Merchant Service can also not provide knowledge or self-help features on its website. The basic FAQ and the handful of guides offered by Wells Fargo Merchant Service have a limited resource of information.

However, it does not mean you cannot rely on this platform when you get problems. Its drawbacks are somehow similar to other merchant services.

When using Wells Fargo Merchant Services, one advantage for you is contacting support at all hours. Besides live chat, it also offers customer service and support mainly through a telephone number appearing on the website which is available 24/07. Additionally, support via a secure email is also available.

Once you set up your account, there will be a relationship manager provided by Wells Fargo to help you. That means you are having a close point of contact for customer service issues and can call them for help anytime you want.

What’s more, though Wells Fargo Merchant Service has a limited resource of knowledge, its guides are useful thanks to the helpful information, especially the Guide to Processing Card Payments and the Cost Management Strategies Guide.

To sum up, the customer service of Wells Fargo Merchant Service is not excellent. You are highly recommended to switch to another service if you always run into complex and account-specific issues. If you just need a merchant service that can answer some basic questions, simply go with Wells Fargo Merchant Service.

User reviews

When it comes to customer reviews, most of them are negative comments and complaints.

You can not find the profile with the BBB but only some information about it under the main bank profile of Wells Fargo. In fact, the company is not accredited by the BBB with a poor F rating, about 3,300 negative reviews filed against it in just 3 years. However, these complaints are not just about the Merchant Services but also other divisions of the company.

What customers may remember about Wells Fargo’s negative reviews is the long list of actions that the government put on the company which includes the remarkable controversy over bogus unauthorized accounts. Although these actions are against Wells Fargo in general, they also affect customers’ decisions while considering doing business with Wells Fargo Merchant Services.

Some of the most common issues that customer negatively comments about Wells Fargo Merchant Services according to sites such as Trustpilot, the BBB, and other third-party review sites are:

- Undisclosed fees while merchants have no idea of what actual fees they have to pay are.

- Customer service of the Wells Fargo Merchant Service is poor, which makes customers wait for so long for support and even solve the problems themselves due to nonexistent customer service.

- Terminal leases price is not reasonable. It is in fact not necessary and users should buy their terminals outright at a more affordable price.

- Withholding funds & Account terminations happen for many reasons.

- Enhanced bill back which is a poorly transparent billing technique used by both Wells Fargo and Fiserv

On the other hand, Wells Fargo Merchant Services still receives positive comments and reviews from its customer testimonials. Wells Fargo Merchant Services is praised for offering users increased security, good customer support, and decreased chargebacks.

Also, the Clover POS system’s usability, inventory management features, and the features of receiving the fund in just one business day are also some functionalities that customers like about Wells Fargo Merchant Service.

What is good about Wells Fargo Merchant Services?

We have reviewed some of the highlighted features that Wells Fargo Merchant Services offers. Now let’s look at its advantages to consider:

Four major credit card networks available

When using Wells Fargo merchant services, you can accept all the major credit cards for your business. Thanks to this plus point, you will not have to worry about spending money on the wrong service that does not allow you to accept the major cards found in your customers’ wallets.

Diverse eCommerce platform integrations

In terms of offering online payment processing for businesses that have many of their transactions online, Wells Fargo allows you to use almost all payment gateways such as Authorize.Net, CyberSource, SecureNet Payment Systems, PayFlow Gateway, and more.

Possibility of funding one day after the purchase

While other services take about 2 days to process a credit card payment, Wells Fargo lets you get your payments processed right the day after the purchase.

It is a great point of it especially when the speed is important to your business. However, you can only approach this benefit if you have your business checking account with Wells Fargo.

What is not good about Wells Fargo Merchant Services?

Here are the reasons why you should not work with Wells Fargo Merchant Services:

Confused rates and fee structures

In fact, Wells Fargo is unclear about their fees and rates. You will not know correctly about your rate structure as well as the rate determination process.

What’s more, your Wells Fargo Merchant Services fees will base on what services are chosen for your business. Being unclear about the rates and fee structures means these accounts can really add up.

You should use another service which is more trustworthy and clear about what you will need to pay.

Working under two different contracts

Once you sign up for Wells Fargo Merchant Services, you have to work with both Wells Fargo and First Data which is the credit card processor.

Remember that First Data can totally pierce their rates and increase your monthly statement fee dramatically. Not only having a more expensive fee but First Data also changes their security features when merchant services for Wells Fargo stay the same.

Expensive cancellation fee

The early termination fee of Wells Fargo Merchant Services is up to $500. You will not receive $500 when you switch to Wells Fargo Merchant Services as it says but only gets a check deposited into your bank account.

$500 is said to be the industry standard but as we research, many other providers don’t take it. For example, Fattmerchant, Dharma Merchant Services, and Helcim.

Weak customer service

Customer support is the most complaint feature of Wells Fargo Merchant Services. You are able to reach them via telephone line, email, and 24/7 service but there are no chat functions on the website.

Offering support for customers via the phone is not as convenient as the direct message.

Summary

Anywhen deciding to make use of any services, it is necessary you should carefully take into account their advantages and disadvantages. Especially when you are running a small business, weighing the pros and cons of Wells Fargo Merchant Services is indispensable.

There are millions of reasons why you should choose this merchant service. If your company has already had a bank account set up with Wells Fargo then this account is perfectly suitable. However, we highly suggest that you should often find another option that does not include so many add-on fees like this. Also, the lack of transparency of this option is also a big drawback that makes you consider more.

Hopefully, our review in this post did give you helpful information about whether to choose Wells Fargo Merchant Services or not. If you have any questions, don’t hesitate to leave us a comment in the section below. Share this article with your friends and visit us for more when you find it interesting.

Thank you!

New Posts

How To Set Up Google Analytics 4 For Your BigCommerce Store